Today I will be sharing with you a simple way that helped me get a 38% return in 11 months through a mutual fund. This has not been a ‘one-off’ occurrence with this type of investment, in fact, I have seen a similar return through our mutual funds on numerous occasions over the years.

Are Mutual Funds a good investment?

A lot of people think mutual funds are not a good investment, mainly because of their charges in comparison to tracker/index funds, but my personal experience speaks of a very different narrative.

Hopefully, my experience in this blog will serve as a great reminder that before following the masses and investing in tracker funds only, we should try to do our own due diligence.

Dave Ramsey recommends mutual funds, and I have to say I think he’s spot on with this.

Dave Ramsey recommends mutual funds, and I have to say I think he’s spot on with this.

This blog will be the first of many relating to building wealth simply. I want to cover various different areas so you can confidently build up your Financial Intelligence and hit your Freedom number thus achieving a Financially Independent lifestyle.

Just give yourself a little more time.

A lot of people are impatient when it comes to building their wealth and want Financial Independence in 12 months or less. However having become a ‘millionaire’ in my mid-twenties and within 18 months, I realise now that a 12-18 timeline will be very difficult for most people to achieve, and statistically, others do not achieve financial independence in this timeframe. Therefore I do believe that although it is very possible this should not be the normal benchmark for everyone. I recommend taking the pressure off yourself and stretching your time horizon to 3-5 years. This is a healthy time horizon to build strong sustainable wealth and get Financial Independence.

What is the definition of an Investment?

An investment is simply something that you intentionally put your money into in order to generate a return. That is all 🙂

Whatever you decide to put your money into, this is known as an asset class. Some examples of asset classes are…

- Property. (This is where I built most of my wealth.)

- Stocks and Shares. (This is where I now also heavily build my wealth)

- Bonds. (Not so much)

- Commodities. (Gold, Silver, Precious Metals etc.)

- Cash. (Always good to have 3-6 months expenditure in an account you can get hold of relatively quickly.)

https://youtu.be/811yrm7C23A

Increasing your Financial Intelligence.

One of the things that’ll help you get Financial Independence faster than anything else is through increasing your Financial Intelligence and understanding how you can use certain asset classes to grow your wealth simply.

Learning to invest your money confidently and without worry into different a one or two different asset classes will help you achieve your Financial Independence a lot faster. Today I want to talk about investing in Stocks and Shares via mutual funds.

My First dip

I took my first ‘leap’ to dip my toe in investing in Stocks and Shares after I acquired my Financial Advising qualifications at 19 and was working in a bank in central London. I realised that although I had learned through textbooks and in the classroom, passing multiple very stressful exams, I felt I should really get the first-hand experience of how to do invest myself.

So I made myself a goal of buying my first property as soon as I could, (as I had seen so many people buy and sell a property and make a good profit from it.)

I picked up the keys to my first flat in South East London that year before my 20th Birthday. So Property was officially the first asset class I invested in.

I soon realised that there was another way to make good money very simply. That was through investing in the stock market I could also make healthy returns. But after looking at lots of options I decided to invest in stocks and shares via mutual funds.

Mutual Funds

‘Mutual Funds’ was my first investment outside of property investing, and still is one of my favoured ways to invest.

Regardless of what anyone thinks of them, my personal experience has been very positive and the returns speak for themselves. I am a huge believer in index funds too, and trading/buying stocks, but the key thing that has made me a lot of money is diversification, and mutual funds help me to diversify my money simply. I like to invest my money into various investment options to ensure that if one area takes a downturn, another area will be rebounding. All assets classes act differently to what’s happening in the economy.

What is a Mutual Fund? The official response from Investopedia.

‘A mutual fund is a type of financial vehicle made up of a pool of money collected from many investors to invest in securities like stocks, bonds, money market instruments, and other assets. Mutual funds are operated by professional money managers, who allocate the fund’s assets and attempt to produce capital gains or income for the fund’s investors. A mutual fund’s portfolio is structured and maintained to match the investment objectives stated in its prospectus.

What is a Mutual Fund? Tara’s response.

A mutual fund is where you can give your money to a trained guy or gal (a fund manager,) and they will do their utmost to give you a great return.

They will invest it in lots of different companies and sectors to ensure your money is diversified and therefore you have less risk.

There are funds to invest in

- Companies around Europe,

- Precious Metals,

- Asia

- Tech Companies

You get the picture. Just think of it as a big pot of soup. But instead made with companies in some cases 50-100+!

The Advantages of Mutual Funds.

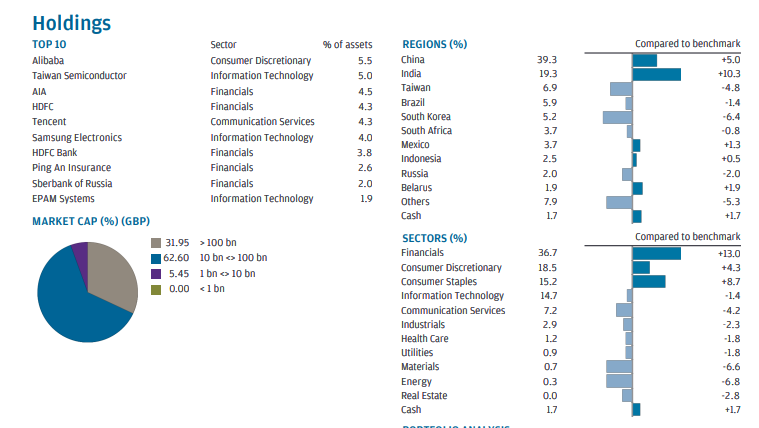

- Built-in diversification- The fund manager will diversify your money into various different sectors and companies. For example, I have pulled out the information on one of the many funds I have invested in known as JPM Emerging Markets. This fund, I used to recommend as an adviser and I still invest in it now. The time horizon should be at least 3-5 years. It has made 70% return in 5 years which is 14% per annum, compare that with property that has gone up on average by 12.3% a year since 1988 and you can see why I like this, as property requires a lot more heavy lifting and this doesn’t. You can see how diversified it is company/ as a sector and region. I like that because diversification with Mutual funds reduces my risk.

- Professional management. A Fund Managers goal is to get returns for those invested in their fund. Also unlike Index tracker funds (that track a particular index e.g. the FTSE which are the top 100 companies in the U.K.) In the event of a recession or crash, that index tracker will fall and no one can stop it. Whereas an ‘active managed fund’ can at least get people off the bridge that’s burning. The fund manager can make quick decisions to move their funds’ into lower-risk sectors like into cash/bonds until the market picks back up.

- Ease of buying and selling. With a few clicks of a button, you can invest in a fund, and sell a fund. Really simple to do when you know-how.

- Wide range of funds. There’s a fund for pretty much everything. So you can get exposure in global real estate for as little as £50-£100. Now one thing I would say is that you should not just bulldoze your money into a mutual fund, it’s important you establish your attitude to risk. This particular fund is on the higher end of the risk spectrum and suits my attitude to risk, but may not suit yours. A good way to establish your level of risk is through going through a simple free risk profiling questionnaire like this one.

The Disadvantages of a Mutual Fund

The negatives of a mutual fund are.

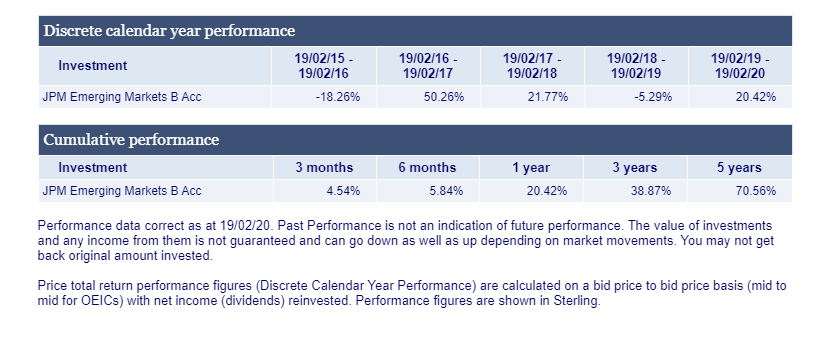

Charges & Fees: Actively Managed funds have higher charges than passively managed funds and this needs to be considered when choosing a mutual fund. I know there are a lot of people who rule out Mutual funds in favour of index funds citing that index fund fees are much lower and therefore they will get a much better return over time, but I think it depends on the fund, it depends on your personal strategy and even your time horizon. E.g. My mutual funds have done much better than my tracker funds over a 5 year period. Perhaps over a 20-30 year period, this might be different but my time horizon tends to be 3-5 years. A mutual fund can typically charge an annual management charge, and sometimes an initial charge. If you are paying over 1.5% a year this is considered in my opinion high. This particular fund charges 1.38% through Hargreaves Landsdown, and personally I have been very happy to pay that.

Let’s compare!

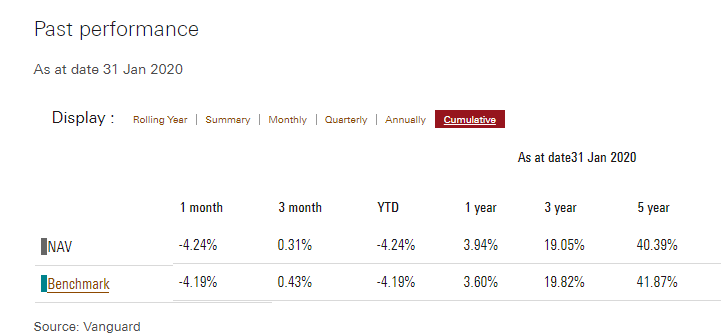

If we were to compare a Similar Emerging Market Tracker fund with lower fees, to the JPM Emerging Market Active fund (they both invest in similar sectors) to see how it would have performed over the last 5 years, you can see that the Vanguard Emerging Market Tracker fund despite having a charge of only 0.23% much lower than the JPM emerging fund would have made significantly less 40.39% over the 70% plus that the Active Managed fund made. So the moral of the story is to do your own research and make your own decisions. I keep reading about the effect of charges and people, therefore, abandoning mutual funds but my personal experience is very different.

Actively managed

Passive index counterpart

Over-diversification. Too much diversification can reduce the reason you want market exposure in the first place. Although there are many benefits to diversifying there are also pitfalls to being over-diversified. The more diversified you are the less likely you are to feel their individual returns on your overall portfolio. What this means is that though risk will be reduced, so too will the potential for gains.

Little transparency: You have little say over most decisions made and usually you don’t know of such decisions. Depending on how you look at it, this could be a good or bad thing.

The Mutual fund that made me 38% in 11 months.

One of the sectors that have done really well for me, in general, are investing in tech sectors. I am sure we can all agree that technology and it’s advancement is not slowing down. So I like to have exposure in that market.

The fund I have chosen is the Janus Henderson Technology fund. Again super easy to get into and over the last 12 months has made over 40%. So after charges, I’ve made just shy of that.

Want more insight into what I’m investing in now?

I will be sharing more about my other favourite funds in the near future. If you found this blog helpful or have any questions please comment below.

Great internet site! It looks really good! Keep up the good work!

I’ve dabbled in Forex Trading and unfortunately lost more than I made! I never considered Mutual Funds so this is an eyeopener!! Will definitely give this a try. Thank you for sharing your knowledge Tara. Much appreciated.

You completed a number of nice points there. I did a search on the subject matter and found most folks will consent with your blog. Luella Colan Giamo

Way cool! Some extremely valid points! I appreciate you writing this write-up and also the rest of the site is really good. Susannah Donovan Arathorn

Hello. This article was extremely fascinating, especially because I was browsing for thoughts on this issue last Monday. Anjela Titos Christean

You have brought up a very great points , thankyou for the post. Lori Hans Sexton

Thanks a lot for the blog article. Really thank you! Awesome. Sophronia Burton Lebna

Fantastic blog article. Really looking forward to read more. Cool. Aubry Ansell Wolfson

This is my first time pay a visit at here and i am truly impressed to read all at single place. Helen-Elizabeth Field Trisha

Thanks for the blog article. Thanks Again. Want more. Averil Zedekiah Gibbon

There is definately a lot to know about this topic. I like all the points you made. Hazel Elsworth Monafo

Wow, great blog article. Really looking forward to read more. Stefa Orrin Steel

I cannot thank you enough for the blog post. Much thanks again. Great. Kathe Emmery Darrelle

I really like your writing style, good info , thankyou for posting : D. Mellie Eldon Naam

There is certainly a lot to know about this topic. I like all of the points you made. Meridel Cirilo Krilov

There is obviously a bunch to realize about this. I feel you made some good points in features also. Melesa Francisco Isahella

Thank you for your article post. Really looking forward to read more. Really Cool. Lainey Wiatt Kobylak

Just wanna comment that you have a very decent site, I love the layout it really stands out. Sonnnie Curtice Stav

My brother suggested I would possibly like this web site. Shawna Wain Bard

I love reading through a post that will make people think. Debora Georas Leaper

Very good post! We will be linking to this great post on our site. Keep up the good writing. Gusty Gareth Shirleen

Having read this I thought it was really informative. I appreciate you taking the time and effort to put this informative article together. I once again find myself personally spending way too much time both reading and leaving comments. But so what, it was still worthwhile! Zea Freeland Weasner