Let’s talk about our ‘Freedom Number.’ I feel that we can get so caught up in amassing wealth and busyness that we can lose sight on of living our core values and therefore easily miss happiness.

Our Freedom number helps us to calculate how much is enough money for us, so we can live a life in line with our core values, authentically spending time with those that matter most.

By knowing our Freedom number we can avoid the hedonistic treadmill.

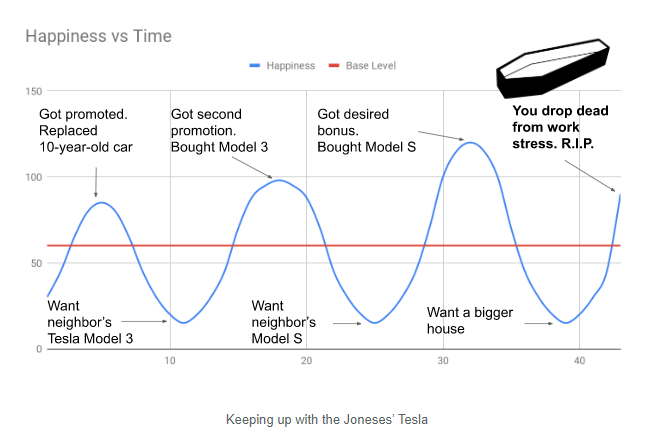

Brickman and Campbell first wrote about the hedonistic treadmill in 1971.

This is the theory that we individually have a natural baseline of happiness, regardless of how much we achieve, we will always return to it.

Therefore it assumes that if we obtain all the things we ever want, e.g (wealth, fame, new car, big house, more time or we reach the top of our professional ladder etc.) We will still return to our normal baseline or ‘set point’ of happiness.

HEDONISTIC TREADMILL, WE ALWAYS RETURN TO OUR SETPOINT.

Your SetPoint.

We all have a natural ‘set point’ of happiness. Some people naturally find it easier to be happy with their life over others, and some don’t, (I’m sure we all know of those ‘glass half empty’ types.) Therefore we must not lose sight of the fact that although we can hit our goals, or achieve those ‘things’ the initial ‘hit of happiness’ will only last a short while, and eventually we will default to our natural ‘set point.’ Many studies have been done on this theory and concluded the same. e.g National lottery winners, wealthy people who have had wild success etc… It’s all temporary. It won’t fulfil us.

Therefore we need to be careful not to pursue the ‘next big thing’ hoping when we get there it will finally bring us the joy and happiness we are searching for. It won’t. The end of the rainbow will disappoint.

The end of the rainbow will not bring long lasting happiness.

Hygge

Hygge

The Finish and the Danish are ranked one of the happiest societies in the world. Could it be because they don’t focus on the ‘pursuit for more?’ The two extremes of the rich-poor divide do not exist. Instead, their focus is on balance, relationship, keeping things simple ‘Hygge’ and giving everyone the same opportunities.

This is why I want to help you get your ‘enough’ and escape the rat race so you can get time freedom to do what you want when you want.

Pursuing Enough

Therefore if the hedonistic treadmill is real, (I believe it is from personal experience), then we have to be contented with what we have now, find happiness through our relationships, ensure we are spending time with those that matter most, that we are looking after ourselves. Ensuring we enjoy the journey.

In terms of wealth, we should focus on getting ‘Enough’ to cover our needs and then regroup and build from there, not crazy wealth that we lose sight of what’s important.

Your Freedom Number

So how can we get you to ‘enough’ wealth?

We have to work out your ‘Freedom number.’ You need to multiply your monthly expenses by 12. This is to get your total annual Freedom number. (Basically how much you would need to live on.)

e.g. if you need £3000.00 per month that’s £36,000 per annum.

Then in order to get the total Freedom asset pot you need, you would multiply £36,000 x 25. (We use 25 because this assumes you will get a 4% annual return from your asset investment.)

Safe Withdrawal Rate 4%

4% is the rate pension providers and Financial Advisors often use as a guide for retirees to ensure they never run out of money. So a good guide for us too.

So in this instance, if we needed £36,000pa we would multiply this x 25 = to give us a total £900,000 asset/savings pot that we need to build. This my friends are your Freedom number.

People spend their lives trying to build up lots of money like this so they can ‘retire.’ Let me show you an easier way!

How You can hit your Freedom number in a fraction of the time.

So you can either

1/ Save £900,000 and ensure you invest it. (like 98% of the population for via a pension.) Then hope that the investment returns over 4% a year, so you can safely withdraw 4% a year without eroding your initial £900,000.

Or

2/ You could use Leverage. Use good debt so you can get to £900,000 portfolio value that yields 4% net a year. Also, you can do this with just £100,000 start-up cash and within 18 months.

So we are aiming to build up a £900,000 portfolio value, you would need to ensure each property you buy yields 4% net a year (net is after costs).

£900,000 x4%= £36,000/12 =£3000pm

Plotting your Escape.

You could buy x 3 Properties valued at £300,000 each, and rent them out using a high cash flowing strategy like HMO or Serviced accommodation/Student lets etc. Each one would need to give 4% net yield or £1000pm. You would need £250,000 to buy 3 of them eek!

Or

You could buy 3 Properties using one pot of cash. e.g.

£200,000 purchase

25% deposit= £50,000 (so you’d have a mortgage at 75% £150,000)

stamp duty £7,500

Legals = £1000

Survey = £500

Add Value to the Asset (spend £30,000 on it)

Total money in = £89,000

~

You then increase it’s value to £300,000

take out a 80% LTV mortgage = £240,000

pay your previous mortgage off =£150,000

and you then are left with £90,000 back in your bank account. WOO HOO!

So you buy another two of those and YOUR FREE 🙂

Helpful?

To learn more about how to do this sign up to my free mini series.

Any questions leave a message below and I’ll come back to you 🙂